Hedge funds struggle to measure overall exposure and keep track of models

Find out how advanced technologies and system integrations are helping hedge funds improve risk visibility and gain a competitive edge.

Model complex instruments, readily launch new strategies, and trade confidently with built-in compliance, all on one transparent, scalable front-to-back platform.

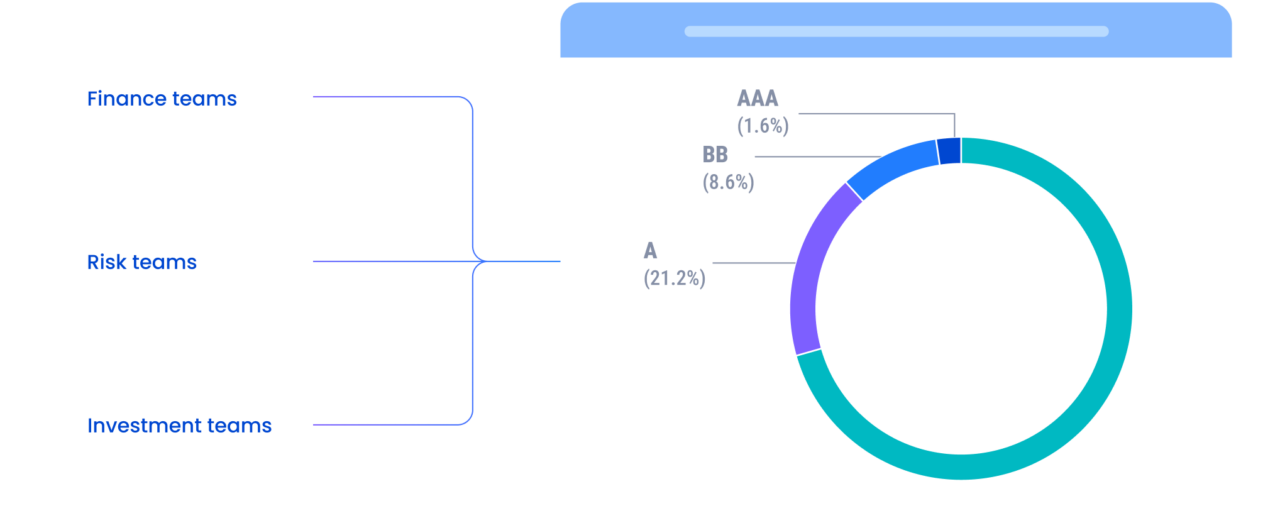

CIOs/PMs are expected to manage investment mandates, generate performance, maintain oversight, and scale investment strategies. But legacy systems, siloed analytics, and conflicting reports stand in the way.

CWAN simplifies investment management for CIOs/PMs by integrating real-time data, analytics, operations, and risk management — giving you the visibility, speed, and control to execute investment decisions anytime.

Assess market shocks and macro events impacts with flexible simulation and stress-testing tools.

Evaluate trade intent against investment restrictions and regulatory limits to help prevent violations before execution.

Access reliable, timely portfolio data — no reconciliation delays and no manual work.

Execute sophisticated strategies across asset classes with built-in pre-trade compliance, customizable blotters, and direct market access.

Launch into new markets without disrupting existing workflows with our unified PMS/OEMS framework.

Support clients with customized, professional statements and reports on demand — no IT bottlenecks or manual formatting.

Designed to support modern investment strategies, CWAN’s capabilities span portfolio modeling, risk management, accounting, and reporting — connecting front-to-back workflows.

Kevin Carney Chief Investment Officer, Security Mutual

CWAN simplifies investment management for CIOs/PMs with a unified platform for performance, oversight, and scale — giving you the speed, accuracy and insights to generate alpha.

Find out how advanced technologies and system integrations are helping hedge funds improve risk visibility and gain a competitive edge.

Enfusion hosted a webinar exploring how asset managers can transform their operational models and reduce complexity through Enfusion Middle and Back Office Services.

The verdict is clear: organic investment performance and client engagement are the twin engines propelling AUM growth.