Australia and New Zealand’s asset managers seek a technology rethink

Asset managers in Australia and New Zealand are becoming increasingly active and sophisticated, but providers have not kept pace.

Managing Director, Product Management & Strategy

Enfusion, a Clearwater Analytics company

Managing Director, Global Head of Middle and Back Office Services

Enfusion, a Clearwater Analytics company

On April 30th, Enfusion hosted a webinar exploring how asset managers can transform their operational models and reduce complexity through Enfusion Middle and Back Office Services. The session was led by Martin Miner, Global Head of Managed Services, and Ian McDonald, Head of Product Management & Strategy. Drawing on decades of experience and live client interaction, the team walked attendees through the latest trends in outsourcing, Enfusion’s unique approach to delivering Managed Services, real client use cases, a product and services overview, and finished with a live Q&A session.

This recap provides a detailed overview of the topics covered for clients who attended—and more importantly, for those unable to join live.

The session began with a sharp focus on industry-wide trends driving outsourcing, particularly in the middle and back office space. Martin shared insights from his career as a former operations leader at major buy-side institutions. He recalled the turning point when he realized that much of the operational workload was no longer a core competency but had instead become a commoditized function.

The pressures of fee compression, talent retention, and the need for real-time decision-making have only accelerated this shift. “There’s nothing heroic about running middle and back office in-house anymore,” Martin remarked. “The real value lies in focusing your team on growth, strategy, and supporting investment decisions—not reconciling trades.”

Ian added that the traditional outsourcing model, which simply takes over workflows without improving them, is becoming obsolete. Today’s asset managers are looking for partners who can enhance workflows, deliver insights, and help scale with agility.

Martin and Ian introduced The Enfusion Advantage, grounded in the belief that outsourcing should not just replicate what’s already being done, but improve it.

What sets Enfusion apart is its deep integration between technology and service. The same cloud-native platform used by clients is also used by Enfusion’s 200+ operations professionals. There’s no data lag, no manual sync between systems, and no dependency on third-party infrastructure. This unified model fosters real-time collaboration, complete transparency, and a faster response to change events like fund launches, counterparty additions, or new asset class adoption.

“We’re embedded in the system just like you are,” Martin explained. “Your pain is our pain. We don’t just deliver information—we deliver intelligence.”

Martin highlighted feedback from existing clients, reflecting the long-term value they’re gaining. Phrases like “pivoting to value-added work,” “foundational for growth,” and “essential and proactive” came up repeatedly in testimonials.

Importantly, these aren’t one-size-fits-all stories. Clients range from emerging managers seeking help with scale to large institutional firms with complex portfolios and bespoke workflows. In all cases, Enfusion’s teams act as an extension of their business, delivering domain expertise, workflow consistency, and flexible engagement models.

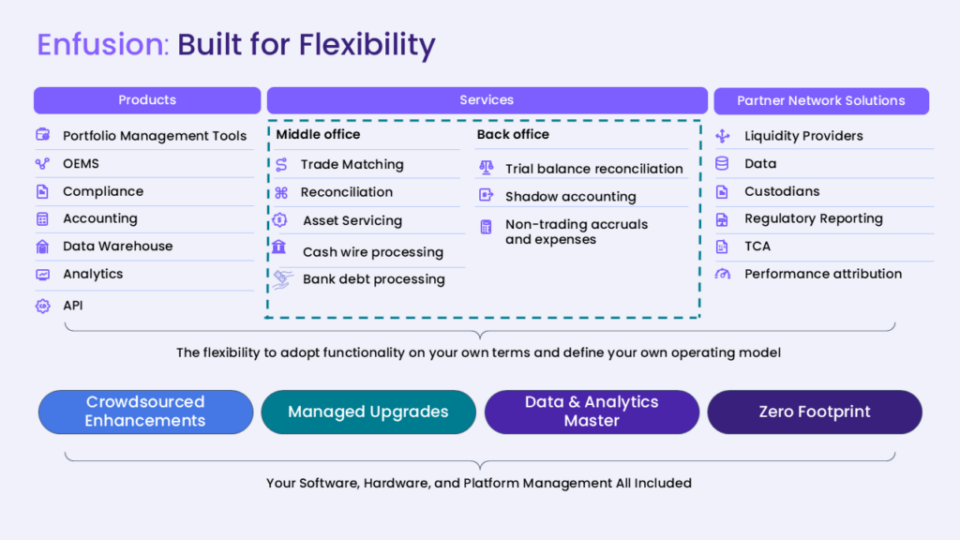

Ian McDonald gave a comprehensive overview of the Managed Services suite, divided into two key pillars:

With 160+ clients, nearly 1,700 funds, and a dedicated team with 70% holding professional certifications, the service is scalable across regions, asset classes, and operational complexity (as of March 2025).

“We’re not just muscle—we’re specialists,” Ian emphasized. “We have bank debt experts, accountants with CPAs, and product SMEs. The team is not generalists—they’re embedded experts aligned to your needs.”

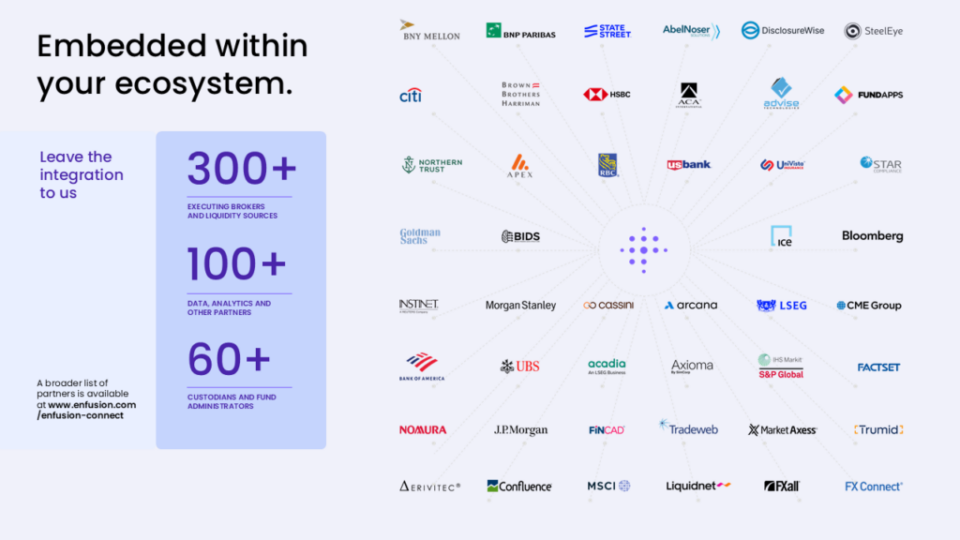

Ian added, “One of the biggest strengths of our platform is our deep library of counterparty connections. We have many examples where clients have started with us small, and a few years later have rapidly grown and evolved. As they trade new asset classes and get into new markets, they need to connect to new counterparties. We can connect them quickly and seamlessly pivot with their workflows and strategy.”

All deliverables flow through a maker-checker process, timestamped and audit-ready, with full SOC 1 Type 2 compliance.

A highlight of the webinar was Ian’s demo of two core client dashboards:

“You can walk into a risk meeting and speak with authority,” Martin said. “You’ll know where the risk is, what’s matched, what’s pending, and who’s resolving it—all before the trading day begins.”

Martin concluded the webinar by reiterating that Enfusion aims to be a long-term partner, not just a vendor. With the recent acquisition by Clearwater Analytics, the platform and service teams are poised to deliver even greater value, with aligned cultures focused on client experience, data integrity, and transparency.

For those who attended, thank you for joining and engaging. If you have follow-up questions or would like an additional demo, please reach out to your account manager directly.

For those who missed the session, we’d love to walk you through what was covered, show you the dashboards, and explore how Managed Services could work for your team. Please contact your Enfusion representative to schedule a follow-up.