May 2023 NAIC Meeting Update

Updates from when the working groups from the NAIC held meetings in May, 2023.

CWAN automates NAIC regulatory reporting by aggregating, reconciling, and validating your investment data — ensuring your quarterly and annual filings are accurate, current, and easy to produce.

Over 100 required NAIC schedules, statements, and exhibits are built from the same data used in your financial statements.

Daily data delivery and ready-to-use reports accelerate month-end and quarterly processes.

Our dedicated regulatory experts keep your reporting aligned with the latest NAIC guidance.

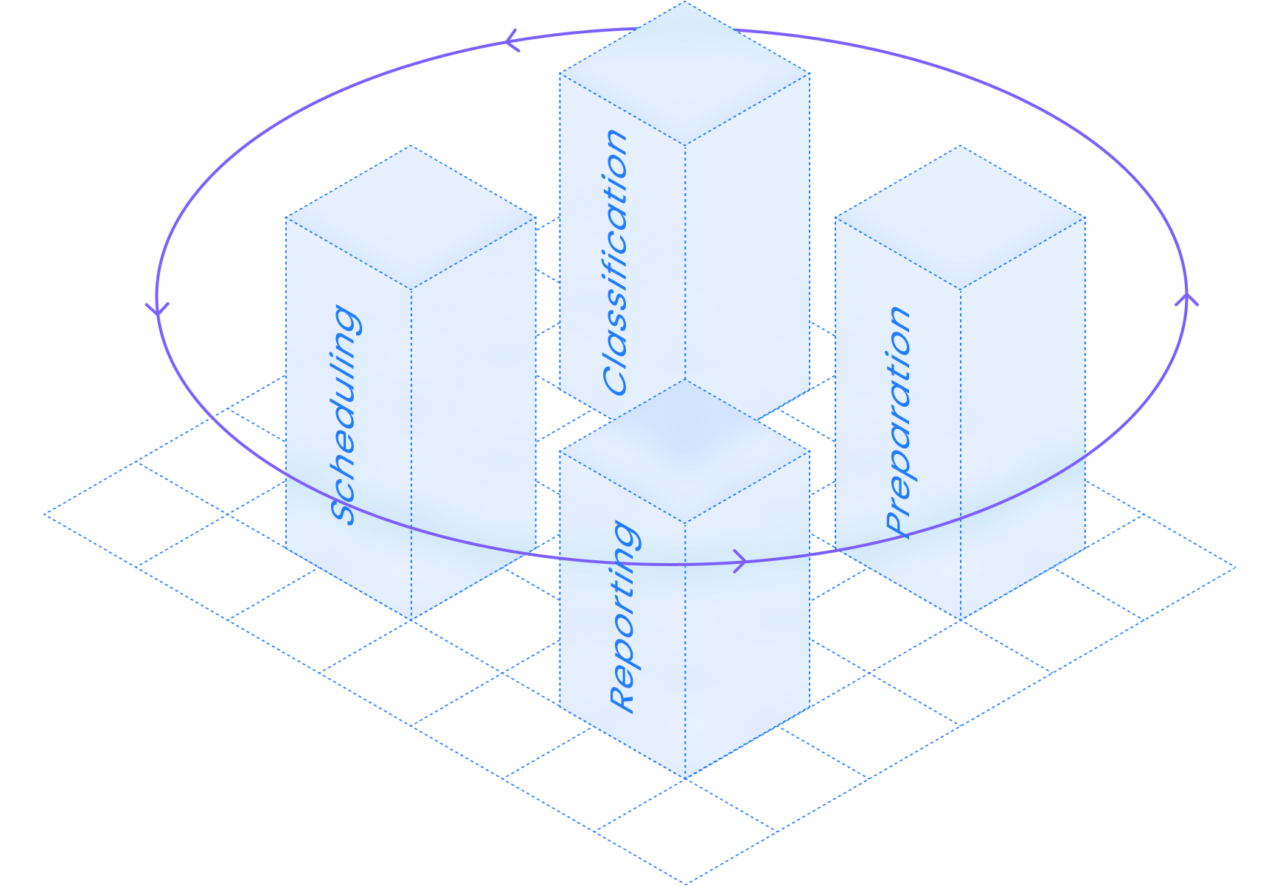

Automate manual processes like classification and schedule generation.

Daily reconciliations and automated checks ensure consistent, regulator-ready outputs.

Every data point is fully auditable, from source trade data to statutory schedules.

NAIC schedules — including D, DA, DB, B, BA, E, E1, E2, and E Parts 1–3 — are automatically generated from your reconciled data, reducing manual preparation and ensuring accuracy.

CWAN prepares Capital Gains (Losses), IMR/AVR, risk-based capital (RBC), and Supplemental Investment Risk Interrogatories (SIRI) reports automatically, so you meet filing requirements without extra steps.

Data is automatically mapped and formatted to meet NAIC filing requirements, reducing manual effort and risk of errors.

CWAN’s regulatory team monitors NAIC guidance and updates asset classifications, reporting codes, and filing templates in real time.

NAIC reporting requirements are the statutory accounting and regulatory filing obligations set by the National Association of Insurance Commissioners. These requirements mandate that U.S. insurers submit quarterly and annual statements — including schedules, exhibits, and notes — to demonstrate solvency, financial condition, and compliance with state regulations.

All U.S. insurance companies — life, property and casualty, health, and reinsurance — must file quarterly and annual statutory statements with the NAIC to demonstrate financial health, risk exposure, and compliance with state regulations.

Statutory statements are detailed regulatory reports, including schedules, exhibits, and notes, that insurers must submit to the NAIC. These statements provide transparency into an insurer’s financial condition, investment holdings, and risk profile.

Schedule D is part of the NAIC statutory statement package and focuses on bond and stock holdings. It provides detailed information about an insurer’s investments, classifications, and valuation.

Risk-Based Capital (RBC) is a framework developed by the NAIC to ensure insurers hold sufficient capital based on their risk exposure. RBC calculations determine the minimum capital required to protect policyholders and maintain financial stability.

NAIC reporting focuses on statutory accounting principles (SAP) to meet regulatory requirements in the U.S., whereas IFRS 17 is a global accounting standard for insurance contract reporting. NAIC filings emphasize solvency and risk, while IFRS 17 focuses on profit and loss recognition and comparability across global insurers.

NAIC filings influence how insurers allocate capital, manage investments, and assess risk. Accurate reporting is critical for maintaining regulatory standing and financial strength ratings, both of which affect market competitiveness.

The NAIC regularly updates guidance and conducts studies on emerging risks, including environmental, social, and governance (ESG) factors. Insurers may be required to disclose climate-related risks or adopt specific risk management practices as part of regulatory filings.

Modern platforms like CWAN automate data aggregation, validation, and reporting for NAIC filings. Technology reduces manual work, minimizes errors, and ensures that regulatory changes are incorporated into reporting workflows seamlessly.

Our dedicated regulatory experts are here to help keep your reporting aligned with the latest NAIC guidance.

Automate statutory schedules, stay current with guidance, and file with confidence using CWAN’s trusted platform.

Updates from when the working groups from the NAIC held meetings in May, 2023.

The Valuation of Securities Task Force (VOSTF) of the National Association of Insurance Commissioners (NAIC) held a virtual meeting on June 18, 2024. The following updates pertain to investment accounting.

Clearwater Analytics’ NAIC Spring National Meeting Market Insight Paper. Discover the latest investment accounting updates from the NAIC’s Spring 2025 National Meeting.