Market brief | US insurers holler for a dollar

As global stock markets teeter near all-time highs, the Research Desk sought to investigate what this exceptional, multiyear run for equities has meant for portfolios.

Consolidate your front-to-back office on a cloud-native, GenAI-enabled, transparent platform to achieve flexibility and accuracy for long-term objectives.

INSURERS CHOOSE CWAN TO

Improve operational efficiency, ensure data accuracy, and strengthen oversight using CWAN’s single-instance, multi-tenant platform with built-in AI.

Gain visibility and easily access daily validated and reconciled data from a platform built for scale and front-to-back investment clarity.

Automate data processing across multiple sources with clean, timely, and enriched data for accurate portfolio accounting and regulatory reporting.

Analyze multi-asset, whole-portfolio exposure to manage risk, conduct scenario analysis, and comply with NAIC and Solvency II regulations.

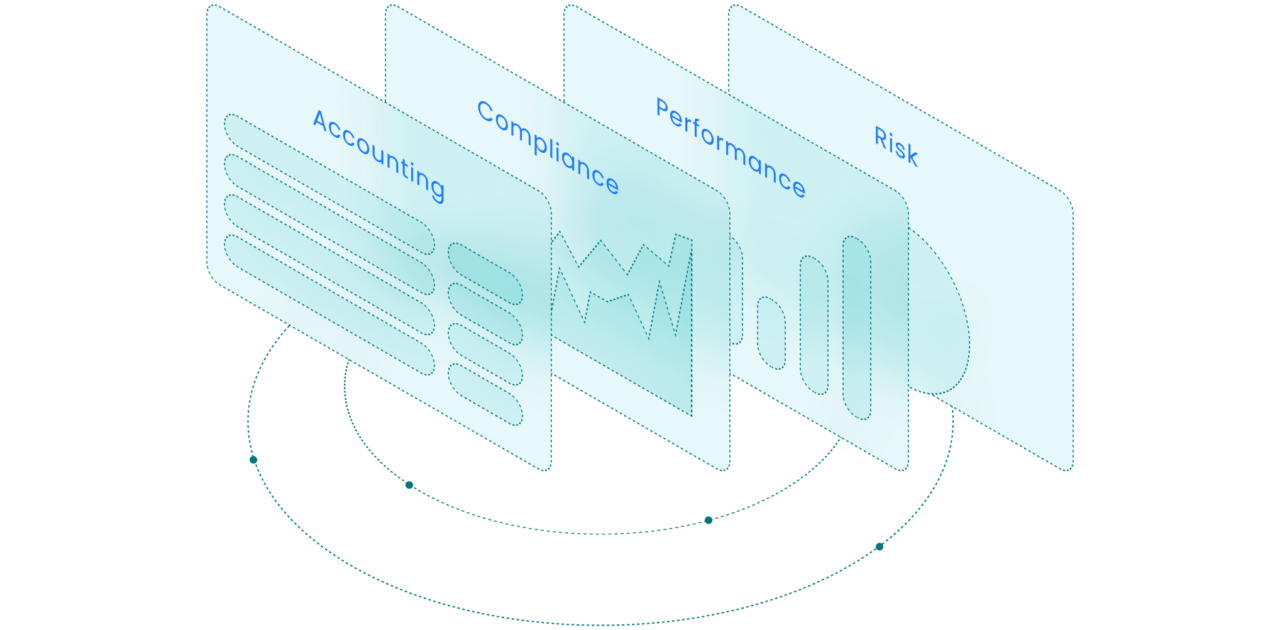

CWAN CAPABILITIES

Simplify operations, improve compliance, and enhance reporting with CWAN’s advanced insurance investment management solutions.

Automate accounting and reporting across GAAP, STAT, IFRS, and tax to reduce month-end close times, ensure ledger accuracy, and integrate seamlessly with GL systems.

Meet insurance-specific reporting requirements with pre-built compliance templates, automated data validation, and audit-ready outputs for global regulatory frameworks.

Catch and resolve issues early with automated checks across portfolios, including daily alerts on limit breaches.

Unite your firm’s investment accounting, compliance, performance, and sophisticated risk management.

Martin Knobbe Head of Middle and Back Office Investment, Versicherungskammer Group

Stephen McLoughlin Investment Services Manager, Delphi Financial Group

Richard Freeman Chief Investment Officer, Industrial Alliance Portfolio Management

Jonny Lee Finance & Investment Operations Director, Aviva

Simplify investment management with CWAN’s cloud-native, built-in GenAI solutions.

As global stock markets teeter near all-time highs, the Research Desk sought to investigate what this exceptional, multiyear run for equities has meant for portfolios.

As global stock markets teeter near all-time highs, the Research Desk sought to investigate what this exceptional, multiyear run for equities has meant for portfolios.

APAC insurers’ appetites for private markets are set to dwarf those for public markets over the next two years, as investment teams are drawn to diversification benefits and return potential.