Hedge funds are on the lookout for new software as a source of competitive advantage

Find out how advanced technologies and system integrations are helping hedge funds improve risk visibility and gain a competitive edge.

Focus on executing investment decisions with a front-to-back, multi-asset, open-architecture platform that’s trusted by 950+ hedge funds and designed to support the unique needs of hedge funds of all sizes and strategies.

HEDGE FUNDS CHOOSE CWAN TO

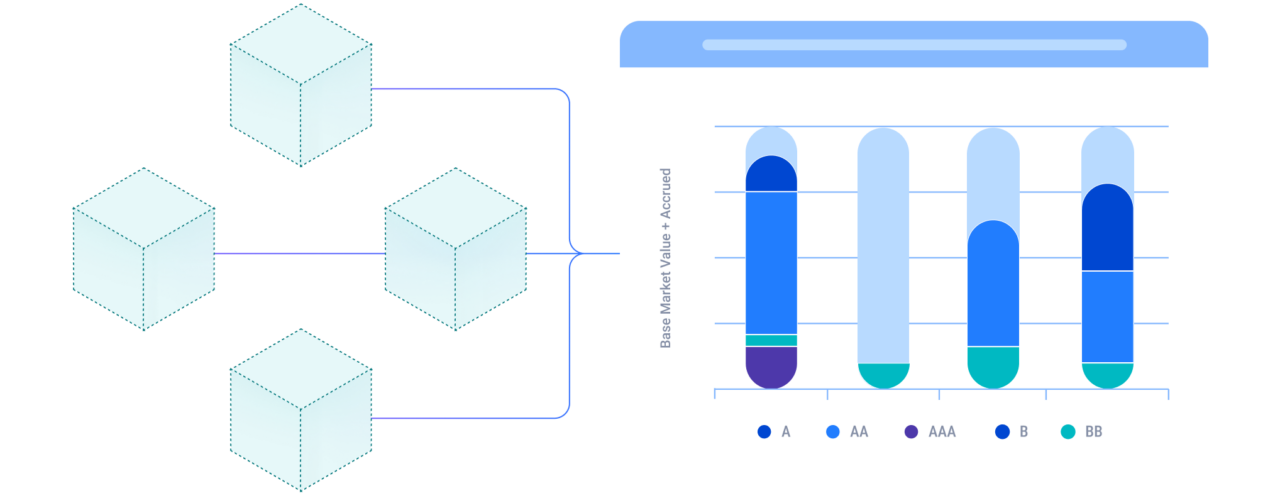

Build a seamless investment management experience with portfolio management, order management, execution management, data management, and shadow accounting.

Add new strategies or trade new securities with one cross-asset, front-to-back platform.

Leverage a single source of positions and transactions with integrated IBOR and ABOR views.

View and model multi-asset risk — from vanilla to exotics — in a scalable, cloud-native platform.

CWAN CAPABILITIES

Streamline investment processes and enhance decision-making.

Rely on continuously updated, reconciled view of positions and cash — so investment and operations teams work from the same truth.

Rest assured that trade restrictions are applied across funds with real-time compliance checks tied directly into trade workflows.

View fast, flexible performance contribution and risk analytics, even for structured products, options, and illiquid instruments.

Automate processes, integrate with proprietary or third-party data or systems, or build extensions to the platform with robust APIs.

Unify trading and operations within a cloud-native platform that spans the entire investment lifecycle, from trade capture to risk management and reporting.

Meet your unique needs with our customizable and scalable open-architecture solution.

Simplify complexity with our flexible platform.

Find new opportunities with new efficiencies.

Get complete front-to-back support.

Gain liquid credit instrument support.

Trade across currencies and jurisdictions.

Streamline event-driven trading.

Chris Sullivan Chief Operating Officer, Chief Financial Officer, and Chief Compliance Officer, CastleKnight

Patrick Mang COO, Trium Capital

Michelle Lim Partner and COO, AIIM Investment Management Hong Kong

Jesse Barnes Co-Founder/CEO, AJO Vista

Nick Vasserman Founder & CIO, IPI

Optimize your investment strategies with greater productivity using flexible technology.

Find out how advanced technologies and system integrations are helping hedge funds improve risk visibility and gain a competitive edge.

Enfusion hosted a webinar exploring how asset managers can transform their operational models and reduce complexity through Enfusion Middle and Back Office Services.

Enfusion’s single cloud-native system consolidates data and processes that are typically spread across multiple platforms into a unified database and toolset, enabling front, middle, and back office functions.