Market brief | US insurers holler for a dollar

As global stock markets teeter near all-time highs, the Research Desk sought to investigate what this exceptional, multiyear run for equities has meant for portfolios.

Complete, timely, and actionable investment data that’s supported by portfolio management, risk analytics, trading, and operational automation to modernize your business.

ASSET MANAGERS CHOOSE CWAN TO

Get out of spreadsheets and fragmented tools and into a single, scalable, cloud-native asset management tool that untangles complexity. Leverage built-in AI to move from insight to action instantly.

Easily manage portfolio construction and execution with operational alignment using CWAN’s AI-enabled, single-instance, multi-tenant solution.

Automatically aggregate, clean, and validate multi-source data, aligning processes from portfolio construction to client and regulatory reporting.

Structure, price, model, and build custom scenarios for complex assets, and run stress tests to manage risk and keep your investments on track.

CWAN CAPABILITIES

Take the next step with a fully integrated asset management solution that adds clarity, precision, and efficiency to your investments.

Establish a single, trusted foundation for performance, reporting, and compliance.

Automate accounting calculations to support timely, accurate, and accessible ABOR.

Attribute performance across strategies, simulate market shocks, and assess portfolio risk.

Gain real-time position and cash tracking across all investment vehicles.

Model, price, and manage complex instruments in an open, cloud-native environment.

Redefine workflows with GenAI that continuously handles reconciliation, reporting, compliance.

CWAN’s asset management solutions seamlessly integrate across the entire investment lifecycle. From initial investment strategy to performance monitoring and reporting, see how CWAN simplifies front-to-back workflows and improves data accuracy.

Whether you’re managing multi-client portfolios, improving client reporting, or optimizing fund performance, CWAN’s asset management solutions streamline operations and provide insights to drive smarter investment decisions.

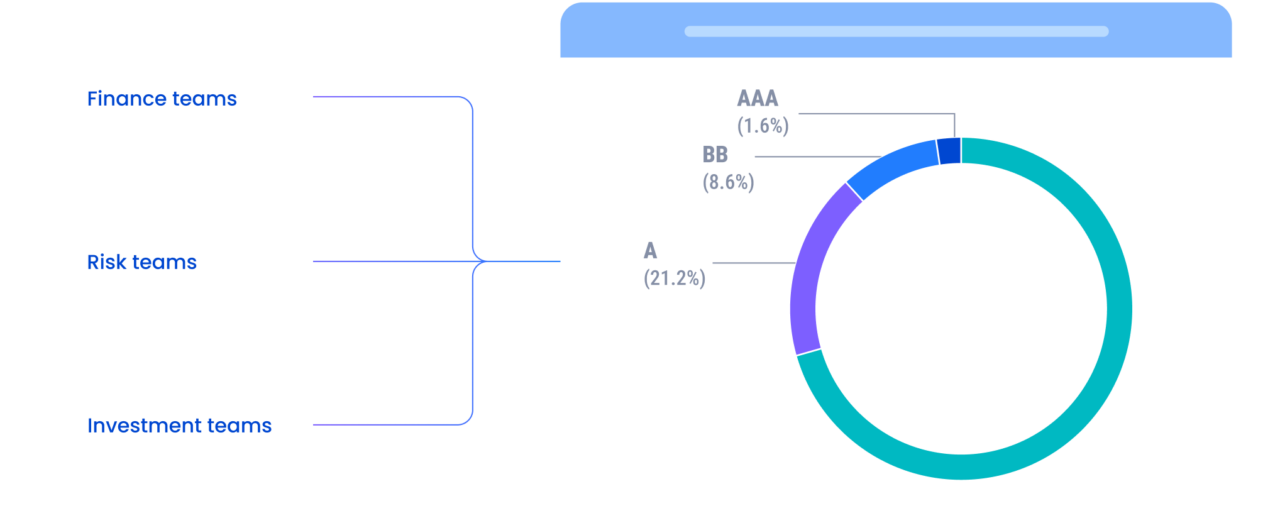

Add precision to complex portfolios with front-to-back visibility, centralized data and reporting, integrated risk analytics, and automated compliance.

Elevate client reporting and portfolio insights with aggregated investment data, customizable client reporting, and streamlined workflows with a single vendor approach.

Manage diverse assets from a single dashboard with visibility across public and private investments to track complex, multi-entity structures with one accounting platform.

Optimize fund operations and risk management with full visibility into multi-asset portfolios, automated NAV calculations, and performance attribution.

Richard Gordon Controller, Prosperity Asset Management

Dirk Manelski Managing Director, Chief Technology Officer, PIMCO

Hugues Bernard Head of Technology and Transformation, Ofi Invest Asset Management

John Stecher Chief Technology Officer, Blackstone

Jeff Robertson Head of Retail Distribution, Enablement and Operations, TD Asset Management

Say goodbye to spreadsheets and fragmented legacy systems.

As global stock markets teeter near all-time highs, the Research Desk sought to investigate what this exceptional, multiyear run for equities has meant for portfolios.

From our experience working with these markets there are two essential ways that Beacon by CWAN boosts risk management for power and gas trading: live risk monitoring and cloud-native scalability.

Key insights from hedge fund COOs on vendor selection and operational resilience at HFM Emerging Managers Summit 2026